how does doordash report to irs

These items can be reported on Schedule C. However if a taxpayer makes an election under IRS Rev.

Does Doordash Track Miles Best Mileage Tracking 4 Highest Deductions

The IRS is investigating complaints from taxpayers who said the IRS 6419 letter does not reflect the accurate amount of Child Tax Credit payments.

. Incentive payments and driver referral payments. Today was my first day I did 5 orders Accepted every order sent to me. Shares of DoorDash Inc surged 165 on Thursday after the food-delivery company beat estimates for quarterly revenue a rare bright spot among stay-at-home darlings that have seen their stocks languish post results.

Income on this platform is a 5050 split between base and tips. If they tell the IRS you made more money than you did the IRS is expecting you to report the extra money on your taxes. Last year this information was reported on Form 1099-MISC box 7.

They have also introduced tools like Wheres My Refund now simply called Check My Refund Status and. The IRS had made huge progress in trying to be transparent about the refund process. Whether the payee vendor or contractor receives a 1099-K or not they are still required to report that income to the IRS and pay taxes accordingly.

DoorDash is an independent contractor and doesnt automatically withhold federal or state income taxes. The IRS used to publish an IRS refund calendar but they discontinued that for the new 21 days for 90 of filers. Also if you dont receive a 1099 you will most likely.

Some will take the position that if the IRS doesnt know you made the money you dont need to report it. Form 1099-NEC reports income you received directly from DoorDash ex. IRS law requires employees to file a record of tips with their employer so the employer can pay the appropriate Social Security and Medicare taxes on that money.

A perk is that drivers can deduct miles driven while Dashing to the Internal Revenue Service IRS. If you cannot pay the full amount you will face penalties and owe. Since dashers are treated as business owners and employees they have taxes payable whether they are full-time dashers or drive for DoorDash on the side.

Like most other income you earn the money you make delivering food to hungry folks via mobile apps such as UberEATS. DoorDash cannot provide you with tax advice nor can we verify the accuracy of any publicly available tax guidance online. What are red flags to get audited.

Instead Dashers are paid in full for their work and must report their DoorDash pay to the IRS and pay taxes themselves when it comes time. You will calculate your taxes owed and pay the IRS yourself. Via this form you report all your annual income to the IRS and then pay income tax on the earnings.

But with every step forward there are two steps back. How to get a Form 1099. It is not Grubhubs job or Doordashs.

Also Doordash has been reimbursing 31 per mile for gas because of proposition 22. Beginning with the 2020 tax year the IRS requires DoorDash to report Dasher income on the new Form 1099-NEC instead of Form 1099-MISC. Can you write off car payments for.

Attractive pay with a side of flexibility makes on-demand food delivery an ideal way to put extra cash in your pocket. What happens if you dont report DoorDash income. August 26 2021 at 948 pm.

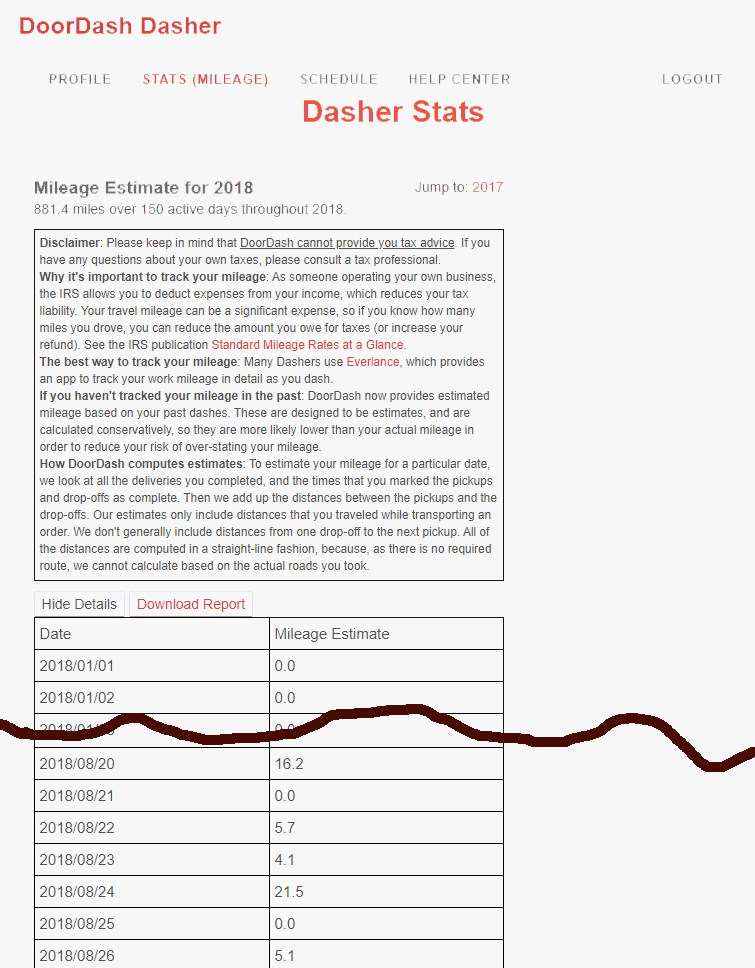

What is reported on the 1099-K. DoorDash doesnt keep track of your mileage as a delivery driver so you cant just login to your Dasher app and get a tax-ready print out of all the mileage you drive for DoorDash. Does DoorDash report to IRS.

Note that you need to report the earnings even. DoorDash does not provide a breakdown of your total earnings between base pay tips pay boosts milestones etc. Do you think thats just the area that you are in.

Coronavirus Relief Fund Grants. If the stock holds its gains it would be DoorDashs best day in nine months and a bounce back from a record low close a day earlier. Doordash is also telling the IRS that you received whatever amount of money they put on the 1099.

Before I go further. Wondering if youll also get a W-2 tax form from DoorDash. 2021-20 for federal purposes California will follow the federal treatment for California tax purposes.

In the US DoorDash requires drivers to manage their taxes through Stripe Express. Grubhub Uber Eats Doordash Instacart and others report our earnings to the IRS through a 1099 form. With zero withheld your taxes will pile up and you will have a big tax bill due Tax Day.

Postmates is well known for being in compliance with state sales tax laws but Uber Eats and DoorDash 1099 contractors have not in the past. Additionally FTB does not anticipate creating any new forms to implement AB 80 but we are in the process of updating line item instructions. It all depends on how much you make and the state you live in.

Essentially if a customer doesnt give a decent tip it wont be worth doing the delivery. For the 2021 year Dashers that make over 600 through the app have to report their earnings. Your teen should report that.

It supports most IRS forms and schedules and provides e-filing in 40 states and the District of Columbia. This is because Dashers are essentially running their own one-man business and that means they can deduct business expenses to lower their taxable income. I am in KentWa 98032.

Cash App Taxes only offers one free DIY tax filing product for both state and federal returns. The busiest of all but also the lowest paying. This sounds like a real drag but actually its a blessing in disguise.

If you have any questions about what to report on your taxes you should consult with a tax professional. Heres the thing. 1 512 499-5127 and Address is 825 East Rundberg Lane Austin TX 78753 Texas United States IRS stands for Internal Revenue ServICE a Government agency which is headed by the director of the treasuryIRS Austin Texas is the part US revenue servICE which.

Please note that the amounts on the 1099-K are not going to be. DoorDash Stock Soars On Fourth-Quarter Earnings Report DoorDash stock soared late Wednesday as the food-delivery company reported quarterly results that beat on revenue but missed on earnings. Yes DoorDash does report its dashers earnings to the IRS since it provides its drivers with 1099-NEC forms.

Top 4 Red Flags That Trigger an IRS Audit. Form 1099-NEC is new. Dont make that mistake.

If you dont report as much as they think you made you get a nice little note from them. Can I still report miles on top of that to the IRS. Whether you are a DoorDash driver for a few.

A lot of people get the idea that Doordash is under the table work or that Grubhub income can go without being reported. Contrary to popular belief you are not guaranteed to receive a 1099 from Postmates. Does DoorDash Report to the IRS.

Does DoorDash keep track of mileage. By Rachel Metz CNN Business CNN -- The next time you try to log in to the Internal Revenue Services website youll be urged to use facial-recognition software to. Unreported income is perhaps the easiest-to-avoid red flag and by.

Does Doordash report to IRS. IRS Austin Texas Contact Phone Number is. Its YOUR job to track your earnings.

Per IRS guidelines Gross Volume processed via the TPSO which in DoorDashs case is the Subtotal and Tax on orders processed. Or realistic in other areas as well. Not reporting all of your income.

Common 1099 Problems And How To Fix Them Doordash Uber Eats Grubhub 2021 Entrecourier

Doordash Mileage Tracking Pilot Program Review Is This A Good Thing For Dashers Entrecourier

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

Doordash Taxes 13 Faqs 1099 S And Income For Dashers

Doordash 1099 Critical Doordash Tax Information And Write Offs Ridester Com

How Do I Calculate Quarterly Taxes Estimates For Doordash Grubhub Uber Eats Postmates And Other Gig Work Entrecourier

Does Doordash Report To Unemployment What To Know Answerbarn